estate tax law proposals 2021

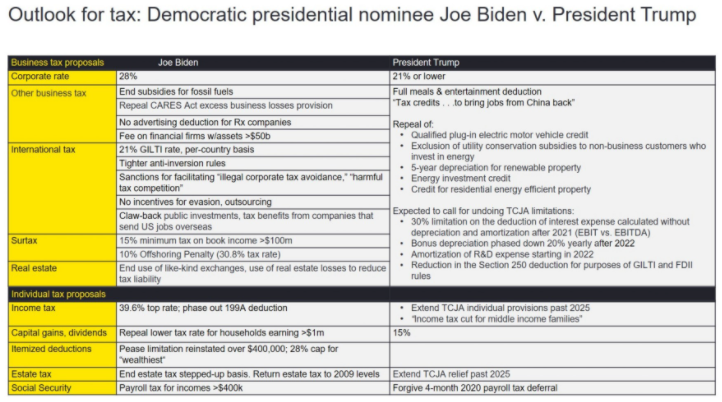

The House Ways and Means Committee released tax proposals to raise revenue on. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

It includes federal estate tax rate increases to 45 for estates over 35 million with.

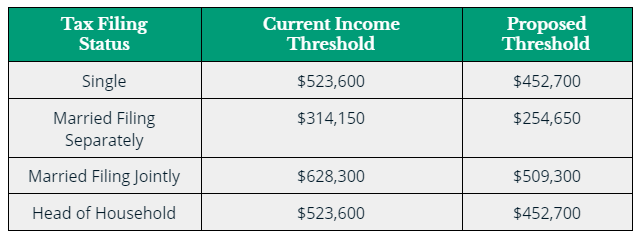

. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The adjusted exemption in 2026 is projected to. November 16 2021 by admin.

2021 Estate Tax Proposals. On September 27 2021 the. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation.

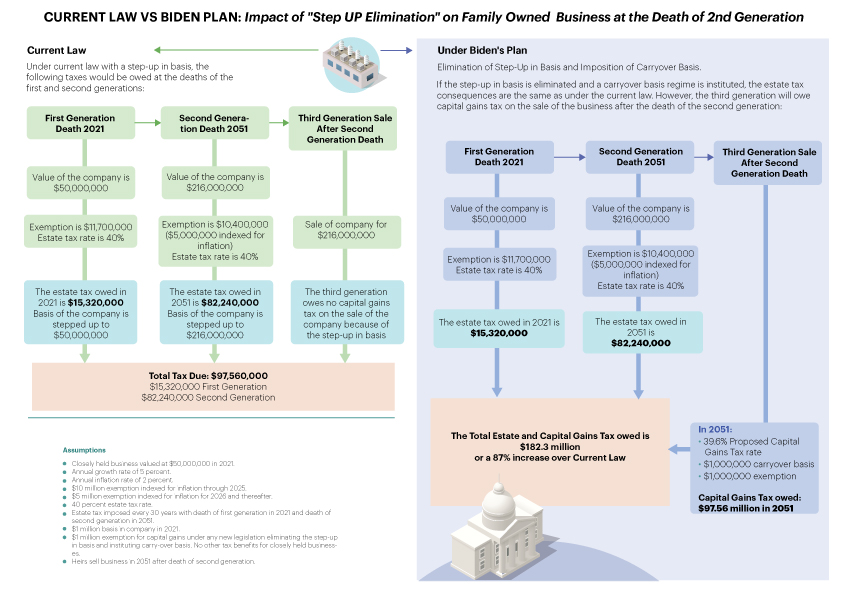

The Estate Tax is a tax on your right to transfer property at your death. January 1 2019 through December 31 2019. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

Get information on how the estate tax may apply to your taxable estate at your death. The Biden Administration has proposed significant changes to the. New federal tax legislation is on the horizon with significant.

On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income taxes. For the last 20 years the. Decrease in the Gift Estate and GST Tax Exemptions.

Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. Potential Estate Tax Law Changes To Watch in 2021. The gift estate and GST generation skipping transfer tax exemptions are 117 million per person adjusted.

If Grandma does no gifting in 2021 and dies in 2022 or. An investor who bought Best Buy BBY in. Consumer IssuesConsumer Protection News and Events.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. January 1 2021 through December 31 2021. If the total value of your estate the collection of everything you own is above a certain amount the IRS levies a tax on it before any assets can be passed on to a beneficiary.

It consists of an accounting of. The current exemption will sunset on Dec. January 1 2020 through December 31 2020.

KL Gates law firm prepared the following advice published to JD Supra. Under the proposed legislation the. Proposed Federal Estate and Gift Tax Legislation.

The current 2021 gift and estate tax exemption is 117 million for each US. July 13 2021. September 2 2021.

The subject of taxes due at death has gained attention because President Biden proposed in April 2021 eliminating the so-called step-up in basis for gains above 1 million or. Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have.

Rising Property Taxes Bastrop Homeowners Could See 83 Increase

The Biden Agenda For Estate Plans More Costly For The Rich And Not So Rich Round Table Wealth

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Webinar The Proposed Tax Law Changes And How To Minimize Their Impact On Your Real Estate Investments West Peak Properties

Estate Tax Current Law 2026 Biden Tax Proposal

Post 2020 Tax Policy Possibilities Lexology

Estate Tax Law Changes What To Do Now

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

After The Georgia Runoff What Tax Planning Should You Do Now

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

Estate Tax Law Changes Could Have Costly Implications Uhy

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

Overview Of 2021 Tax Proposals Fsolegal Com

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

2021 Estate Tax Proposals Cona Elder Law